The millennial generation is the largest generation in United States history. According to the US Census Bureau:

“[Millennials] born between 1982-2000, now number 83.1 million and represent more than one- quarter of the nation’s population. Their size exceeds that of the 75.4 million baby boomers.”

If you are one of the millions of millennials who have seen their peers begin to buy homes recently and are wondering what it would take for you to do the same… you’ve found the right eGuide!

There are many stereotypes and myths about the millennial generation as a whole, AND about what it takes to buy a home in today’s market.

These myths have prevented many millennials from even considering homeownership as an option for them and their families.

At Leigh Brown & Associates, One Community Real Estate®, we’re here to provide you with the information you will need to make the best decision for you and your family in regards to homeownership. We will break down the myths and stereotypes that have long been believed to be true, as well as shed light on the opportunity you have to build wealth using your monthly housing cost.

You’re Not Alone If You Haven’t Bought a Home Yet

If it seems like all your friends are buying a house… it’s because they are! But don’t worry, you’re not alone if you haven’t.

There has been a lot of talk about how, as a generation, Millennials have ‘failed to launch’ into adulthood and have delayed moving out of their family’s home. What doesn’t seem to be mentioned in the same context, however, is the large number of Millennials who have moved out of their family’s home, but have been renting an apartment, condo, or even a house!

Many experts have looked at the homeownership rate among Millennials and have questioned if they even want to own homes! The great news is that not only do Millennials want to own… they are flocking to the real estate market in larger numbers every year!

Buyers aged 18-34 years have comprised the largest share of first-time homebuyers at roughly 50-60% for the last few years. In 2017, buyers aged 25-34 years accounted for 65% of first-time home buyers, compared to 50% in 2005.

According to the National Association of Realtor’s latest Profile of Home Buyers and Sellers, the average age of a first-time homebuyer in 2017 was 32. This generation will continue to be the topic of conversation A LOT when it comes to housing as more and more enter the ‘average home-buying age’.

What’s Holding Millennials Back from Buying?

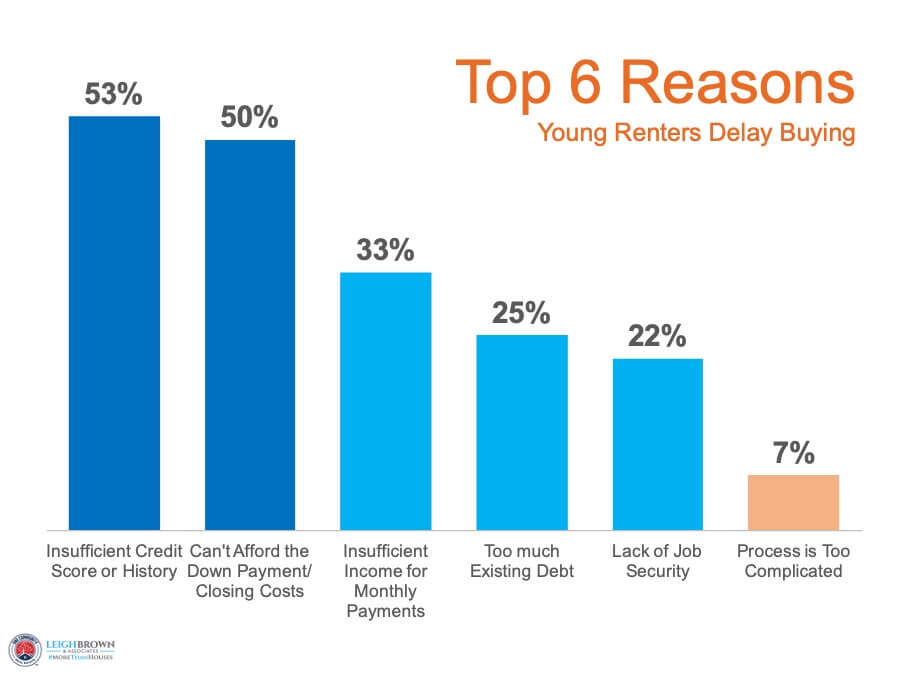

The answer must be student loans, right? Wrong! While paying back an education is part of the equation for some, it is not the only factor that holds Millennials back from buying their first homes. A survey of young renters by Fannie Mae found that the factor that delays the most potential buyers is an insufficient credit score or history (53%), followed closely behind by “affording the down payment and closing costs (50%).”

There are many potential homebuyers who have delayed their purchase because they ‘believe’ that they do not qualify with the debt they have (debt-to-income ratio), their credit score or even the amount of savings they have.

The challenge is that many of those who delay their purchases are not aware of the opportunities available, and are not aware that they would qualify now. Instead of wasting time paying rent, they could be building their own wealth by putting their housing costs to work for them through the equity in their home.

Let’s Break Down the Top 3 Myths Holding Back Buyers:

Myth 1:

Student Loans are Preventing Millennials from Buying

Millennials are on track to becoming the most educated generation in history. This means they are also the generation with the most student debt. Depending on the type of degree earned, as well as the prestige of the institution attended, there are some Millennials who graduate college with what equates to a mortgage payment. But that’s not the case for all.

Here are some statistics about the average college graduate & their student loans:

- The age of the average college graduate is 22 years old.

- The average student graduates college with $25,000 in student loan debt.

- The terms of the average loan are 10 years, with a monthly loan payment of $280, and an interest rate of 6.8%.

Looking at these stats, the average college graduate has what amounts to a 10-year car payment after graduation.

Is Earning a Degree Worth the Debt?

According to a study by the Brookings Institute, the dividing line between haves and have-nots in homeownership is “education, not student debt.”

“This picture accords with what we know about the growing gulf in the economic fortunes of those with and without a college education. Men with a BA earn $35,000 more a year than those without, while for women the gap is $25,000.”

A study by Fannie Mae supports this fact as they go on to say:

“Those who completed at least a bachelor’s degree without student debt were 43% more likely to be homeowners than high school graduates who didn’t attend college and don’t have student debt.”

The College Board reports that “the typical bachelor’s degree recipient can expect to earn about 66% more during a 40-year working life than the typical high school graduate earns over the same period.”

Millennials are delaying the social norms that many generations before they had set. According to NAR, Millennials who purchased a home last year delayed their home purchase by a median of 3 years, with 53% of those who delayed their purchase citing student loans as the debt that held them back the most.

Student loans have only delayed their ability to own their own home, not taken away the desire to do so.

Reasons Those with Student Loans Are Delaying Buying a Home:

- 85% – Can’t save for a down payment because of student debt

- 74% – Don’t feel financially secure enough because of existing student debt

- 52% – Can’t qualify for a mortgage due to debt-to-income ratio (DTI)

- 47% – Can’t afford their preferred house or neighborhood

- 18% – Don’t have the financial know-how to confidently navigate the housing market

Seems like there is some work to be done to educate those with Student Loan debt that they may be disqualifying themselves and may be able to buy now:

Can’t save for a down payment – What size down payment do they think they need?

Can’t qualify for a mortgage due to debt-to-income ratio (DTI) – There is a big difference between your front-end DTI and your back-end DTI. The front-end DTI measures the amount of your monthly income that you will be spending on your mortgage payment. The back-end DTI takes into consideration your entire monthly expenses (or debts) in comparison to your monthly income.

According to Ellie Mae’s Origination Report, loans closed over the last year had an average front-end DTI of 25% and an average back-end DTI of 39% which is much higher than many believe they need.

The last one is where your agent comes in: Don’t have the financial know-how to confidently navigate the housing market – Your agent, aka Me – Leigh Brown with One Community Real Estate®, should be your strategic partner throughout the home buying process. I am here to answer your questions and put your mind at ease about the big decisions that you will be making in order to make your dream of owning a home come true!

“With student debt on the rise, there’s been a lot of speculation about whether the cost of a college degree hurts an individual’s ability to buy a home,” says NerdWallet’s Chris Ling. “From what we’ve seen, getting a four-year degree or higher is actually positively associated with homeownership — even when accounting for debt.”

Thousands of ‘Older Millennials’ are reaching the 10-year mark after college and paying off their student loan debt every day. Many more who may have graduated with more than average debt is one or two years out from being able to lift that financial burden and are daydreaming about what the future will bring.

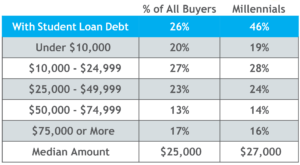

46% of homebuyers in 2017 had student loan debt at the time of purchase.

In NAR’s Student Debt & Housing Report, 19% of those with student loans were already homeowners.

Many took advantage of the first-time homebuyers’ credit and are now looking to sell their homes and move on to accommodate their more ‘grown-up’ lives. For example, some may now be married, with a better job, possibly with kids or one on the way, or aging parents that they will soon need to accommodate.

According to NAR’s Generational Study, 46% of all Millennial homebuyers in 2017 purchased their homes while still paying off their student loans. Although this is a larger percentage than the 26% of all buyers who had student debt at the time of their home purchase, the distribution of the amount of debt is consistent with all buyers.

Myth 2:

You Need a 20% Down Payment to Buy a Home

Gone are the days of 20% down or no loan, but recent surveys reveal that many Americans are not aware that programs exist to put down less.

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.”

The survey results revealed that consumers often overestimate the down payment funds needed to qualify for a home loan; 76% of respondents either don’t know (40%) or are misinformed (36%) about the minimum down payment required.

Many believe that they need at least 20% down to buy their dream home, but many programs actually let buyers put down as little as 3%.

Here are the results of a Digital Risk survey of Millennials who recently purchased homes.

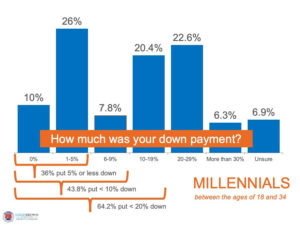

Since Millennials make up the largest share of first-time buyers, it should come as no surprise that 97% of this generation financed their home purchase, compared to 86% of all buyers.

What may come as a surprise to many who have not yet purchased, however, is that 16% of those who financed their home put 0% down!

61% of Millennials who purchased a home in 2017 put down 10% or less!

According to data from the last 12 months of Ellie Mae’s Millennial Tracker, the average down payment for a Millennial was 10%.

Your dream home could be within your reach much sooner than you ever thought if you only need to save up 3-10% instead of the 20% that you may have thought you needed!

Depending on where you live, median income, median rents, and home prices all vary.

Myth 3:

You Need ‘Perfect Credit’ to Buy a Home

What is a credit score? According to Investopedia, “a credit score is a statistical number that depicts a person’s creditworthiness. Lenders use a credit score to evaluate the probability that a person repays their debts. Companies generate a credit score for each person with a Social Security number using data from the person’s previous credit history.

A credit score is a three-digit number ranging from 300 to 850, with 850 as the highest score that a borrower can achieve. The higher the score, the more financially trustworthy a person is considered to be.”

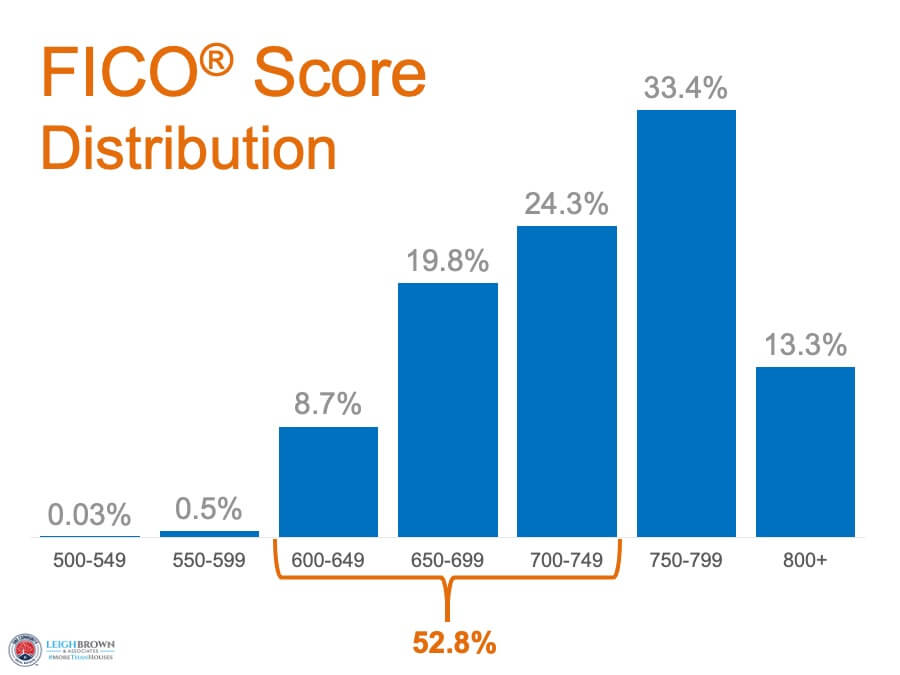

Fannie Mae’s survey also revealed that 59% of Americans either don’t know or are misinformed about what FICO® credit score is necessary to qualify. Many Americans believe a ‘good’ score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As you can see on the right, 52.7% of approved mortgages had a FICO® score between 600-749.

Over the last 12 months, the average FICO® Score for home purchases by Millennials was 723!

Don’t make the mistake of disqualifying yourself by thinking you need a 780 score.

The Financial Benefits of Homeownership

According to a report by Trulia, “buying is cheaper than renting in 100 of the largest metro areas by an average of 37.4%.” That may have some thinking about buying a home instead of signing another lease extension, but does that make sense from a financial perspective?

In the report, Ralph McLaughlin, Trulia’s Chief Economist, explains:

“Owning a home is one of the most common ways households build long-term wealth, as it acts like a forced savings account. Instead of paying your landlord, you can pay yourself in the long run through paying down a mortgage on a house.”

The report listed five reasons why owning a home makes financial sense:

- Mortgage payments can be fixed while rents go up.

- Equity in your home can be a financial resource later.

- You can build wealth without paying capital gains.

- A mortgage can act as a forced savings account.

- Overall, homeowners can enjoy greater wealth growth than renters.

Let’s expand more on #1 from this list: “mortgage payments can be fixed while rents go up.”

Don’t Get Caught in the Rental Trap

They say the only guarantees in life are death and taxes, but it seems like they should also add rent increases to that list.

A whopping $485.6 billion was spent on rents in the U.S. in 2017. This represents an increase

of over $17.7 billion from the year before. As shown in the chart on the right, rents have increased consistently over the last 20+ years.

There are many benefits to homeownership. One of the top ones is being able to protect yourself from rising rents by locking in your housing cost for the life of your mortgage.

In an article by The Mortgage Reports, they report that “buying and owning a home is the essence of ‘The American Dream.’ Each month, your housing payments go toward owning your home instead of renting it; building your personal wealth and assets instead of someone else’s.

History has shown that homeownership is a clear path to wealth-building, with homeowners boasting a net worth [that is] multiples higher than the net worth of renters.”

Why Millennials Choose to Buy

According to NerdWallet’s Millennials & Homebuying Study, the top 5 reasons young renters choose to own are:

To Have Control over their Living Space – 93%

Many Millennials who rent a home or apartment prior to buying their own homes, dream of the day that they will be able to paint the walls whatever color they’d like, or renovate an outdated part of their living space.

Many others who have waited to add a pet to their families daydream about the day that they’ll be able to go pick out their ‘furever’ friend. Owning your own home gives you the freedom to make those choices.

To Have a Sense of Privacy & Security – 90%

It is no surprise that having a place to call home, with all that means, in comfort and security, is the #2 reason. As a homeowner, you have control over who has access to your home, and you are able to secure it how you see fit.

To Live in a Nicer Home – 81%

Similar to the #1 reason, when you purchase a home, you can choose to live in a nicer home or choose to renovate a home & restore its glory. Owning also allows you to accommodate your growing family or a family member who may need to move in.

To Feel Engaged in Their Community – 75%

Owning a home in a community is one of the major reasons why residents become more civically involved. The stakes are raised once your home value is directly tied to the neighborhood and community in which you live.

To Have Flexibility in Future Decisions – 53%

As we mentioned earlier, owning a home allows you to use your monthly housing cost as a savings account that can be borrowed against in the future. Having this option available during uncertain times is just one of many reasons why homeowners feel more secure in their homes.

Tips for Preparing for Homeownership

Realtor.com shared ‘5 Habits to Start Now if you Hope to Buy a Home.’ Below are the top three from their list with a brief description.

#1 – Automate Your Down Payment Savings

One way to jump start your down payment savings is to automate your checking account to automatically save a small amount of your paycheck into a separate savings account or ‘house fund’.

“Amassing enough for a down payment takes discipline & perseverance, but setting up automatic savings can make it easier. If you never see the cash, you won’t spend it.”

#2 – Build Your Credit History & Keep It Clean

When you go to apply for a mortgage, lenders will want to see that you have been able to pay off past debts. This means staying on top of your student loans, credit cards, and car loans and paying them on time! Credit bureaus recommend using no more than 30% of the credit available to you.

#3 – Practice Living on a Budget

Downsizing your spending now will allow you to save more for your down payment & pay down other debts to improve your credit score. A study by Bank of America showed that “95% of first- time buyers were willing to make sacrifices to buy their home faster.” The top 3 sacrifices cited by Millennials when saving for a home are: cutting back on new clothes, a new car, and travel.

Know Your Credit Score

Knowing your credit score and getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Here are some tips for improving your credit score:

- Make payments, including rent, credit cards, and car loans, on time.

- Keep your spending to no more than 30% of your limit on credit cards.

- Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

- Check for errors on your credit report and work toward fixing them.

- Shop for mortgage rates within a 30-day period — too many spread-out inquiries can lower your score.

- Work with a credit counselor or a lender to improve your score.

Show Sellers You Are Serious… Get Pre-Approved

In many markets across the country, the number of buyers searching for their dream homes greatly outnumbers the number of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.

Even if you are in a market that is not as competitive, knowing your budget will give you the confidence of knowing if your dream home is within your reach.

Freddie Mac lays out the advantages of pre-approval in the ‘My Home’ section of their website:

“It’s highly recommended that you work with your lender to get pre-approved before you begin house hunting. Pre-approval will tell you how much home you can afford and can help you move faster, and with greater confidence, in competitive markets.”

One of the many advantages of working with a local real estate professional is that many have relationships with lenders who will be able to help you with this process. Once you have selected a lender, you will need to fill out their loan application and provide them with important information regarding “your credit, debt, work history, down payment and residential history.”

Freddie Mac describes the 4 Cs that help determine the amount you will be qualified to borrow:

- Capacity: Your current and future ability to make your payments

- Capital or cash reserves: The money, savings, and investments you have that can be sold quickly for cash

- Collateral: The home, or type of home, that you would like to purchase

- Credit: Your history of paying bills and other debts on time

Getting pre-approved is one of the key steps that will show home sellers that you are serious about buying, and it often helps speed up the process once your offer has been accepted.

Ask Your Lender About Down Payment Assistance Programs

When you meet with your lender to become pre-approved, also ask them if there are any down payment assistance programs that you may qualify for. There are hundreds of different programs throughout the country.

Eligibility requirements vary depending on your location and are generally limited to first-time and/ or low- and moderate-income homebuyers. Several programs specifically benefit veterans, Native Americans, and workers employed in education, health care, law enforcement, and firefighting.

The U.S. Department of Housing and Urban Development (HUD) gives grants to state and local organizations nationwide. These organizations, in turn, use these funds to help homeowners bridge the down payment gap.

Every little bit helps when accumulating the funds needed to get you into your dream home.

What to Look for in Your Real Estate Team

By now, you’re probably pretty pumped and really want to find your dream home. So how do you select the members of your team that are going to help you make that dream a reality?

What should you be looking for? How do you know if you’ve found the right agent or lender?

The most important characteristic that you should be looking for in your agent, is someone who is going to take the time to really educate you on your choices and your ability to buy in today’s market.

As Dave Ramsey, ‘the financial guru’, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

At Leigh Brown & Associates, One Community Real Estate®, we are the REALTORS® you want on your side. Our team is honest and trustworthy, after all, you will be trusting them with helping you make one of the biggest financial decisions of your life. We are your strategic partners.

Whether this is your first or fifth time buying a home, you want to make sure that you have an agent who is going to have the tough conversations with you, too, not just the easy ones. If your offer isn’t accepted by the seller, or they think that there may be something wrong with the home that you’ve fallen in love with, you would rather know what they think than make a costly mistake.

~ Leigh Brown and Team

We are grateful for our Community!

Leigh Brown & Associates, One Community Real Estate®